Students from non-EU/EFTA countries

Childpage navigation

Students from non-EU countries have two options:

- buy a Swiss health insurance for international students;

- ask for an exemption from health insurance in case you hold a private insurance at home. Similar requests are usually rejected by the health authorities.

1. Health insurance for international students

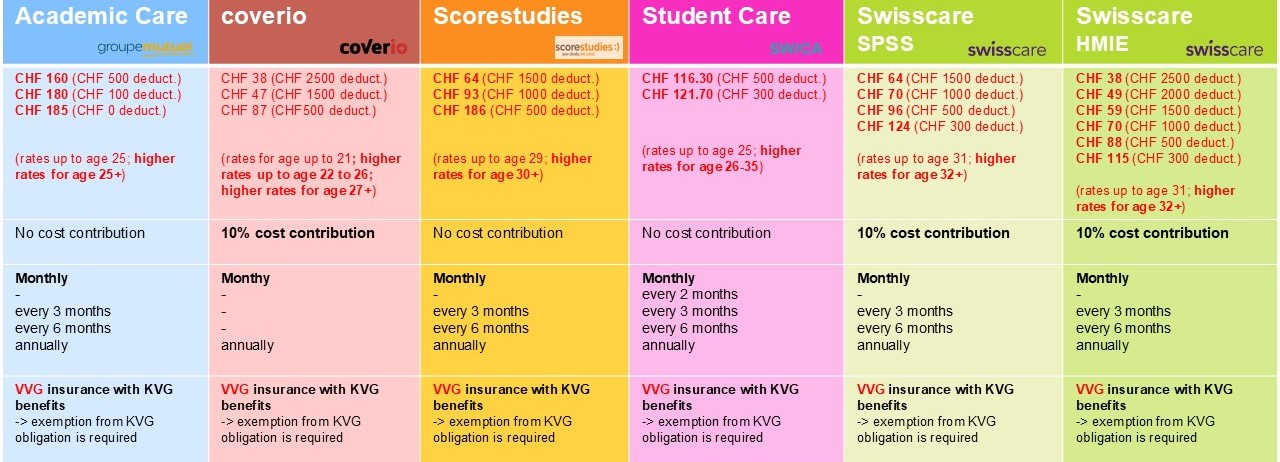

Choose among the following options (in alphabetical order):

The health insurance packages for international students do not operate under the Federal Health Insurance Act (KVG), rather according to the "Federal Insurance Contract Act" (VVG) law. Therefore, in case you take one of the packages, you must apply for an "exemption from the Swiss health insurance obligation according to the KVG law".

Note

- Non-EU students: Exemption as indicated for each insurance.

- EU students: Check with the health authorities if exemption is possible.

Academic Care by Groupe Mutuel is a student insurance package for international students.

If you choose Academic Care, there will be no additional cost contribution of 10%.

Monthly premiums for students under 18

(for details about when exactly you fall into the next age category, please refer to the Download Special Terms and Conditions (PDF, 167 KB))

- CHF 96 (with an annual deductible of CHF 500)

- CHF 116 (with an annual deductible of CHF 100)

- CHF 121 (with an annual deductible of CHF 0)

Monthly premiums for students aged 19 to 25:

- CHF 160 (with an annual deductible of CHF 500)

- CHF 180 (with an annual deductible of CHF 100)

- CHF 185 (with an annual deductible of CHF 0)

Monthly premiums for students over 26:

- CHF 270 (with an annual deductible of CHF 500)

- CHF 290 (with an annual deductible of CHF 100)

- CHF 295 (with an annual deductible of CHF 0)

As follows your next steps:

- a) You live in the city of Zurich:

> when you register at the Residents' Registration Office for your residence permit, you will receive a letter with information on health insurance (cf. Download sample letters (PDF, 1.4 MB)). You are required to inform them about your insurance plan. Read the letter carefully and take action once you have clarified which plan is for you.

b) You live outside the city of Zurich:

> when registering for the residence permit, ask your city/municipality how to apply for the health insurance exemption with a Swiss health insurance for international students. - Open external page www.groupemutuel.ch/eth and read everything carefully. Decide on your annual deductible (CHF 500, CHF 100 or CHF 0). Please follow the instructions on the website carefully. Should you have any questions, contact the person mentioned on the Groupe Mutuel website.

We do not recommend to go to a Groupe Mutuel agency in person since the staff there will not be familiar with the procedures of this specific product. - Print and complete the external page insurance proposal and send it to the address mentioned on the Groupe Mutuel website (by post or email). Please include a copy of your residence permit and a confirmation of matriculation at ETH Zurich.

- Wait for the insurance policy and the insurance card to be sent to you by post. You can also download the app and have the insurance card in digital form.

- Apply for the "Exemption from compulsory health insurance". The exemption process is different in each canton. On external page www.coverio.ch, you can find further information about the exemption process in your canton of residence. Click on "external page Good to know".

coverio health insurance protects against the financial consequences of illness or an accident. At attractive prices, coverio offers cover similar to statutory health insurance.

You will have to pay the standard cost contribution of 10%.

Monthly premius for student aged 21 and under:

CHF 38 (with an annual deductible of CHF 2500)

CHF 47 (with an annual deductible of CHF 1500)

CHF 87 (with an annual deductible of CHF 500)

Monthly premiums for students aged 22 to 26:

CHF 43 (with an annual deductible of CHF 2500)

CHF 52 (with an annual deductible of CHF 1500)

CHF 97 (with an annual deductible of CHF 500)

Monthly premiums for students aged 27 to 33:

CHF 49 (with an annual deductible of CHF 2500)

CHF 56 (with an annual deductible of CHF 1500)

CHF 112 (with an annual deductible of CHF 500)

Monthly premiums for students aged 34 and over:

CHF 99 (with an annual deductible of CHF 2500)

CHF 117 (with an annual deductible of CHF 1500)

CHF 199 (with an annual deductible of CHF 500)

As follows your next steps:

- a) Live in the city of Zurich?

> when you register at the Residents' Registration Office for your residence permit, you will receive a letter with information on health insurance (cf. sample letters). You are required to inform them about your insurance plan. Read the letter carefully and take action once you have clarified which plan is for you.

b) Live outside the city of Zurich?

> when registering for the residence permit, ask your city/municipality how to apply for the health insurance exemption with a Swiss health insurance for international students. - You can easily access the insurance visiting external page www.coverio.ch. Choose the "Calculate premium" button and read through the information. Select the option that is best for you. Fill out the form online and your insurance is secured.

- In a confirmation e-mail, you will receive your personal coverio insurance policy, which contains all the important information. These you will need for the exemption process.

- Apply for the exemption from the compulsory KVG health insurance obligation. The exemption process is different in each canton. On external page www.coverio.ch, you can find further information about the exemption process in your canton of residence. Click on "external page Good to know".

Scorestudies offers a student insurance package for international students. Scorestudies includes higher benefits than the KVG. In case of emergency, hospitalisation or prescribed medication, you are reimbursed as from the CHF 1.

If you choose Scorestudies, there will be no additional cost contribution of 10%.

Monthly premiums (Essential plan) for students up to 29:

CHF 64 (with an annual deductible of CHF 1500)

CHF 93 (with an annual deductible of CHF 1000)

CHF 186 (with an annual deductible of CHF 500)

Monthly premiums (Essential plan) for students aged 30-34:

CHF 111 (with an annual deductible of CHF 1500)

CHF 146 (with an annual deductible of CHF 1000)

CHF 255 (with an annual deductible of CHF 500)

Monthly premiums (Essential plan) for students over 35:

CHF 117 (with an annual deductible of CHF 1500)

CHF 179 (with an annual deductible of CHF 1000)

CHF 318 (with an annual deductible of CHF 500)

Check out the Premium plan for a worldwide coverage (including dental and optical coverage). Switching between plans is possible.

A 24/7 multilingual support is provided and most medical claims are reimbursed within 2 working days (MyHealth App)

As follows your next steps:

- a) Live in the city of Zurich?

> when you register at the Residents' Registration Office for your residence permit, you will receive a letter with information on health insurance (cf. Download sample letters (PDF, 1.4 MB)). You are required to inform them about your insurance plan. Read the letter carefully and take action once you have clarified which plan is for you.

b) Live outside the city of Zurich?

> when registering for the residence permit, ask your city/municipality how to apply for the health insurance exemption with a Swiss health insurance for international students. - Visit external page www.scorestudies.ch/en/apply, read everything carefully and apply online for your preferred insurance plan (Essential or Premium).

- Follow the instructions and wait until you receive your insurance policy and access to your e-card via app by email in 2 business days.

- Apply for the exemption from the compulsory KVG health insurance obligation

Student Care by SWICA is a student insurance package for international students.

If you choose Student Care, there will be no additional cost contribution of 10%.

Monthly premiums for students under 26 (higher prices for students over 26):

- CHF 116.30 (with an annual deductible of CHF 500)

- CHF 121.70 (with an annual deductible of CHF 300)

Please go ahead as follows:

- a) Live in the city of Zurich?

> when you register at the Residents' Registration Office for your residence permit, you will receive a letter with information on health insurance (cf. Download sample letters (PDF, 1.4 MB)). You are required to inform them about your insurance plan. Read the letter carefully and take action once you have clarified which plan is for you.

b) Live outside the city of Zurich?

> when registering for the residence permit, ask your city/municipality how to apply for the health insurance exemption with a Swiss health insurance for international students. - Scan/photograph your ETH confirmation of matriculation and your registration confirmation from the Residents' Registration Office or your Swiss residence permit (front and back) in good quality and save both on your computer.

These documents have to be uploaded later on during the online application process. - Complete the online application form at external page www.swica.ch/en/eth-student-care and submit.

- You will receive a confirmation email containing your insurance proposal. This is for your guidance only. It does NOT have to be sent anywhere!

- Wait for the insurance policy and the insurance card to be sent to you. In addition, it is possible to register with MySWICA where the insurance card is stored digitally.

- Apply for the exemption from the compulsory KVG health insurance obligation

Swisscare offers a selection of two student insurance packages for international students: SPSS- and HMIE-Plan.

SPSS-Plan - Insurance package for international students

You will have to pay the standard cost contribution of 10%.

Monthly premiums (Standard plan) for students up to 31:

- CHF 63 (with an annual deductible of CHF 1500)

- CHF 70 (with an annual deductible of CHF 1000)

- CHF 96 (with an annual deductible of CHF 500)

- CHF 124 (with an annual deductible of CHF 300)

Monthly premiums (Standard plan) for students over 32:

- CHF 83 (with an annual deductible of CHF 1500)

- CHF 94 (with an annual deductible of CHF 1000)

- CHF 118 (with an annual deductible of CHF 500)

- CHF 147 (with an annual deductible of CHF 300)

HMIE-Plan insurance package for international students

You will have to pay the standard cost contribution of 10%.

Monthly premiums (Essential plan) for students up to 31:

- CHF 38 (with an annual deductible of CHF 2500)

- CHF 49 (with an annual deductible of CHF 2000)

- CHF 59 (with an annual deductible of CHF 1500)

- CHF 70 (with an annual deductible of CHF 1000)

- CHF 88 (with an annual deductible of CHF 500)

- CHF 115 (with an annual deductible of CHF 300)

Monthly premiums (Essential plan) for students from 32 - 45:

- CHF 56 (with an annual deductible of CHF 2500)

- CHF 67 (with an annual deductible of CHF 2000)

- CHF 81 (with an annual deductible of CHF 1500)

- CHF 92 (with an annual deductible of CHF 1000)

- CHF 108 (with an annual deductible of CHF 500)

- CHF 136 (with an annual deductible of CHF 300)

Monthly premiums (Essential plan) for students over 46:

- CHF 179 (with an annual deductible of CHF 2500)

- CHF 204 (with an annual deductible of CHF 2000)

- CHF 228 (with an annual deductible of CHF 1500)

- CHF 250 (with an annual deductible of CHF 1000)

- CHF 272 (with an annual deductible of CHF 500)

- CHF 281 (with an annual deductible of CHF 300)

Monthly premiums (Superior plan) for students up to 31:

- CHF 67 (with an annual deductible of CHF 2500)

- CHF 85 (with an annual deductible of CHF 2000)

- CHF 106 (with an annual deductible of CHF 1500)

- CHF 115 (with an annual deductible of CHF 1000)

- CHF 135 (with an annual deductible of CHF 500)

- CHF 166 (with an annual deductible of CHF 300)

Monthly premiums (Superior plan) for students 32 - 45:

- CHF 99 (with an annual deductible of CHF 2500)

- CHF 118 (with an annual deductible of CHF 2000)

- CHF 137 (with an annual deductible of CHF 1500)

- CHF 147 (with an annual deductible of CHF 1000)

- CHF 167 (with an annual deductible of CHF 500)

- CHF 199 (with an annual deductible of CHF 300)

Monthly premiums (Superior plan) for students from 46:

- CHF 284 (with an annual deductible of CHF 2500)

- CHF 321 (with an annual deductible of CHF 2000)

- CHF 376 (with an annual deductible of CHF 1500)

- CHF 412 (with an annual deductible of CHF 1000)

- CHF 448 (with an annual deductible of CHF 500)

- CHF 463 (with an annual deductible of CHF 300)

For both plans proceed as follows:

- a) Live in the city of Zurich?

> when you register at the Residents' Registration Office for your residence permit, you will receive a letter with information on health insurance (cf. Download sample letters (PDF, 1.4 MB)). You are required to inform them about your insurance plan. Read the letter carefully and take action once you have clarified which plan is for you.

b) Live outside the city of Zurich?

The procedure will be different and you may not receive a letter. You should ask about it at the municipal administration ("Gemeindeverwaltung") when you apply for your residence permit. - Visit external page https://swisscare.com/, choose "Let's start" and select "Student insurance". Follow the instructions. Read everything carefully, compare the different insurance plans (SPSS: Standard, Comfort, Premium or HMIE: Essential, Superior) and decide on which one suits you best. external page Direct link to SPSS plan.

- Open the confirmation email and follow the instructions.

- Wait for the insurance policy and the information regarding the digital insurance card through the MySwisscare app.

- Apply for the exemption from the compulsory KVG health insurance obligation

Of course you are free to choose a KVG insurance on your own by using one of the online premium comparison services.

Please go ahead as follows:

- a) Live in the city of Zurich?

> when you register at the Residents' Registration Office for your residence permit, you will receive a letter with information on health insurance (cf. Download sample letters (PDF, 1.4 MB)). You are required to inform them about your insurance plan. Read the letter carefully and take action once you have clarified which plan is for you.

b) Live outside the city of Zurich?

The procedure will be different and you may not receive a letter. You should ask about it at the municipal administration ("Gemeindeverwaltung") when you apply for your residence permit. - Visit external page https://en.comparis.ch/krankenkassen or external page www.priminfo.admin.ch/de/praemien (available in German, French, Italian) and choose your favoured insurance plan. Please note that special packages for international students do not appear on these websites.

- Order an offer online via Comparis / Priminfo or visit the website of the insurance company you chose and order it via that website.

- Wait for the offer, sign it and send it back to the insurance company.

- Live in the city of Zurich?

Follow the link as on the information on health insurance (or the QR code) and fill in the name of the insurance company of your choice within the deadline (cf. letter 1, Download sample letters (PDF, 1.4 MB))

- this is your response to their first letter and informs the authorities about the name of the insurance company you have chosen. - Inquire about a external page premium reduction -> Online Form: Antrag auf Prämienverbilligung (only in German) for which you can apply once you have been living in the same canton for at least 3 months.

Please check with the insurances directly if they offer the private patient or half-private patient option.

Some insurances offer additional supplementary insurance such as dental coverage or a liability/household insurance:

- Academic Care: contact Mr. Conte external page gconte@groupemutuel.ch, he will help you in finding the best solution for an external page additional supplementary insurance (such as dental, private in the hospital, alternative medicine etc). You can add a private liability and/or a household insurance in addition to a health insurance.

- Score Studies: offers with the external page premium plan some dental and optical coverage. You can add a external page private liability and/or a houshold insurance in addition to a health insurance.

- Student Care (SWICA): for the conclusion of supplementary insurances, the ordinary conditions of admission apply with answers to your health. This may then be subject to a coverage exclusion or rejected for the additional supplementary insurance. Contact external page Student Care directly for further details.

- Quick Cover (by Swisscare): For the acquisition of external page supplementary insurances (such as private liability, household, legal protection, travel, cyber and tuition fee insurance). You can also find all the options directly on external page www.quickcover.ch.

- For further information see private liability insurance.

- Don't forget to check the SPAM folder from time to time.

Note:

ETH Zurich does not make any recommendation as to which health insurance company you should choose and has no advantages by listing the products. They are accepted by the Health Department of the Canton of Zurich. The choice of a suitable health insurance is solely up to you.

2. Students with a private insurance from their home country

Students who have a private insurance from their home country can also apply for an exemption. Please note, however, that it is extremely rare that such exemption requests are approved. We strongly recommend buying a Swiss health insurance for international students from the start.

If you still wish to attempt the exemption from the Swiss health insurance obligation, follow the instructions in the specific section of our webpage.

In case your application for an exemption has been refused by the SVA Zurich, your immediate reaction will be extremely important to avoid being forcefully insured. This can get very expensive!

Contacts

For BSc, MSc, Joint Master and MAS students

For exchange students

ETH Zurich

Raemistr. 101

HG F 23.1

8092

Zurich

Switzerland